IRS 1098-T 2024-2025 free printable template

Show details

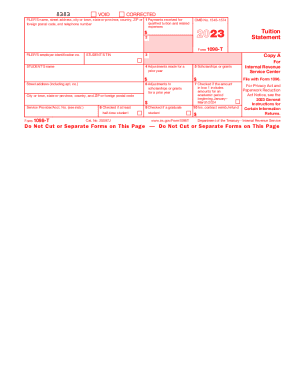

See Publications 1141 1167 and 1179 for more information about printing these forms. VOID CORRECTED FILER S name street address city or town state or province country ZIP or 1 Payments received for qualified tuition and related foreign postal code and telephone number expenses OMB No. 1545-1574 Tuition Statement Form 1098-T FILER S employer identification no. Attention Copy A of this form is provided for informational purposes only. Copy A appears in red similar to the official IRS form* The...

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS Form 1098-T

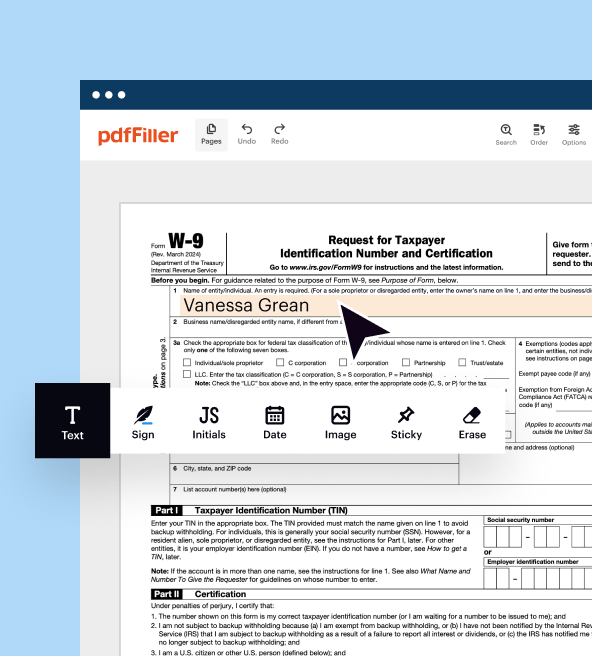

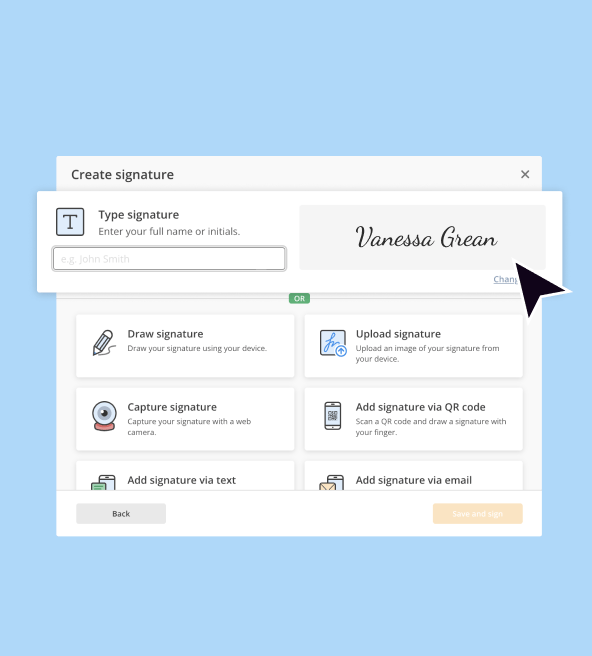

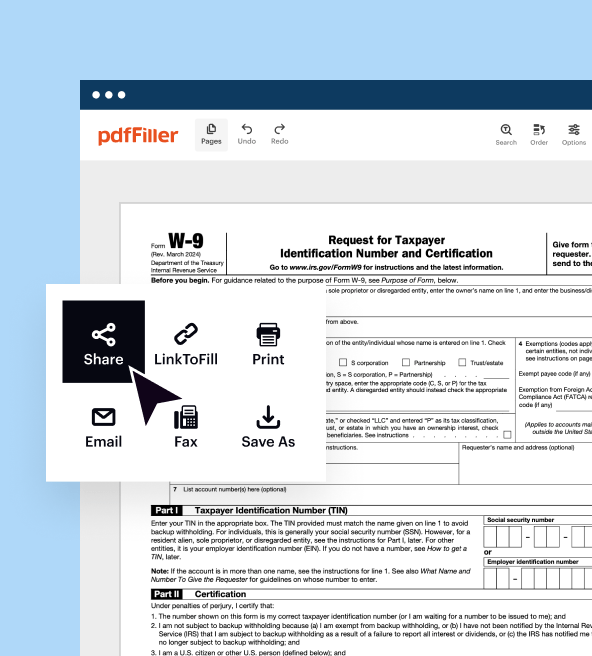

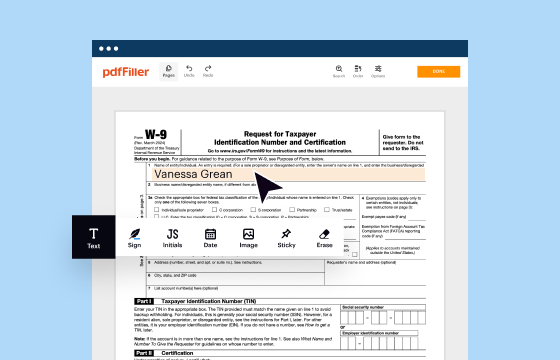

Step-by-Step Instructions for Editing IRS Form 1098-T

How to Complete IRS Form 1098-T Effectively

Understanding and Utilizing IRS Form 1098-T

The IRS Form 1098-T is a key document for students and educational institutions in tracking higher education expenses. It provides important information about qualified tuition and related expenses, which can impact tax deductions and credits. This guide will walk you through the steps necessary to understand and effectively complete this form, ensuring you maximize potential tax benefits.

Step-by-Step Instructions for Editing IRS Form 1098-T

Editing IRS Form 1098-T requires attention to detail to ensure accurate reporting of tuition payments. Follow these steps:

01

Obtain the blank IRS Form 1098-T from the IRS website or your educational institution.

02

Verify the institution’s information, including the name, address, and Employer Identification Number (EIN).

03

Fill in the appropriate box with the student’s details, including Social Security Number (SSN) and course year.

04

Input qualified tuition and related expenses in the designated sections, adjusting for any scholarships or grants received.

05

Review the form for accuracy and completeness before submitting.

How to Complete IRS Form 1098-T Effectively

Completing the IRS Form 1098-T correctly is essential for ensuring that students receive the correct tax benefits. Here's how:

01

Enter the student’s personal information accurately, ensuring the SSN matches IRS records.

02

Box 1: Payments received for qualified tuition and related expenses.

03

Box 2: Amounts billed for qualified tuition (obsolete since the 2018 tax year).

04

Box 5: Scholarships or grants.

05

Make sure to check the checkbox if the student was a graduate student, as this affects eligibility for credits.

Show more

Show less

Latest Developments and Modifications to IRS Form 1098-T

Latest Developments and Modifications to IRS Form 1098-T

Staying current with updates to IRS Form 1098-T is crucial. Recent changes include:

01

The introduction of new reporting requirements for educational institutions regarding unqualified expenses.

02

Changes to eligibility for certain education tax credits, such as the American Opportunity Tax Credit (AOTC).

03

Tax year adjustments that affect qualified tuition expenditure limits.

Essential Insights into IRS Form 1098-T

What is IRS Form 1098-T?

The Purpose Behind IRS Form 1098-T

Who Needs to Complete IRS Form 1098-T?

Exemption Criteria for IRS Form 1098-T

Key Components of IRS Form 1098-T

Submission Deadline for IRS Form 1098-T

Distinguishing IRS Form 1098-T from Similar Forms

Transactions Covered by IRS Form 1098-T

Number of Copies Required for Submission

Penalties for Failing to Submit IRS Form 1098-T

Information Required for Filing IRS Form 1098-T

Other Accompanying Forms with IRS Form 1098-T

Where to Submit IRS Form 1098-T

Essential Insights into IRS Form 1098-T

What is IRS Form 1098-T?

IRS Form 1098-T, officially called "Tuition Statement," is used by eligible educational institutions to report qualified tuition and related expenses paid by students. This information can lead to federal tax credits and deductions for students or their parents.

The Purpose Behind IRS Form 1098-T

The primary purpose of Form 1098-T is to provide taxpayers with the information needed to claim tax benefits related to higher education. This includes credits such as the American Opportunity and Lifetime Learning Credit, enhancing the affordability of education.

Who Needs to Complete IRS Form 1098-T?

Educational institutions are required to complete and provide Form 1098-T for each eligible student. Students do not file this form with their tax returns but use it to determine eligibility for education tax benefits.

Exemption Criteria for IRS Form 1098-T

Exemptions from filing IRS Form 1098-T can apply under specific conditions, including:

01

If the student is enrolled in a course that is not degree-seeking.

02

Students whose tuition is entirely covered by scholarships.

03

Institutions that have fewer than 250 students.

04

Institutions that operate on a non-profit basis.

Key Components of IRS Form 1098-T

The form consists of several boxes that report critical financial details. The main components include:

01

Box 1: Shows total payments received for qualified expenses during the year.

02

Box 2: Details the amount billed for qualified tuition (note: no longer applicable).

03

Box 5: Reports scholarships or grants received.

Submission Deadline for IRS Form 1098-T

Educational institutions must send out the IRS Form 1098-T to students by January 31 of the year following the tax year. This aligns with the individual taxpayer's deadline to file their federal tax return, usually April 15.

Distinguishing IRS Form 1098-T from Similar Forms

IRS Form 1098-T is often compared to other IRS forms such as 1098-E and 1099-Q. Key differences include:

01

Form 1098-E is used for reporting interest paid on student loans.

02

Form 1099-Q pertains to distributions from 529 savings plans.

03

Form 1098-T specifically addresses tuition and educational expenses directly.

Transactions Covered by IRS Form 1098-T

This form predominantly covers tuition payments, related fees, and the associated scholarships or grants. However, it's important to note that expenses such as room and board are generally not included unless specified under qualified expenses.

Number of Copies Required for Submission

Two copies of the IRS Form 1098-T are typically required: one for the institution's records and one for the student. The student may need to keep this for their records when claiming tax credits.

Penalties for Failing to Submit IRS Form 1098-T

Institutions that fail to file Form 1098-T may face significant penalties, including:

01

Failure to file penalties that can reach up to $270 per form, depending on the duration of delinquency.

02

Additional penalties if the IRS determines that incomplete or inaccurate information was provided.

03

Repeated offenses can lead to escalated penalties or audits.

Information Required for Filing IRS Form 1098-T

Educational institutions must gather the following information to complete IRS Form 1098-T:

01

The student's full name and SSN.

02

Details of tuition payments received within the tax year.

03

The total amount of scholarships or grants provided to students.

Other Accompanying Forms with IRS Form 1098-T

In certain cases, IRS Form 1098-T may be accompanied by additional forms, such as Form 8863 (Education Credits) when claiming credits for qualified education expenses.

Where to Submit IRS Form 1098-T

IRS Form 1098-T does not require separate submission by the students but should be retained for their records. Educational institutions must file this with the IRS, either electronically or via mail, to the specified address provided by the IRS.

Understanding IRS Form 1098-T is essential for students and educational institutions to navigate the complexities of educational tax benefits. By taking the necessary steps to complete the form accurately, you can ensure compliance and maximize your potential tax advantages. For further assistance or to start the filing process, consider reaching out to a qualified tax professional or utilizing reliable online resources.

Show more

Show less

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Very helpful and easy to navigate awesome program

Need to be able to copy and Paste when needed

Try Risk Free